bustocaido.online Tools

Tools

Balance Transfer Credit Cards Comparison

Why we like the Citi Double Cash Card as the best for fair credit scores. The Citi® Double Cash Credit Card offers a generous 0% intro APR on balance transfers. Platinum Preferred Mastercard ; New Card Offer. Earn 2% Cash Back on balance transfers with no balance transfer fee. ; Summary. Save money on interest payments. Find 0% balance transfer credit cards that make sense for you. Review credit card balance transfer products in a variety of styles and options. You can expect to pay a balance transfer fee of 3% to 5% of the amount you're transferring, but you don't have to pay this fee out of pocket. Instead, it's. You can easily move the balance from another credit card to your Navy Federal Credit Card. If you don't have one yet, check out our options or see if you're. With a Wells Fargo balance transfer credit card, you can pay off higher interest rate balances, cover planned or unexpected expenses, and simplify your. Card comparison tool Compare credit cards side-by-side. See your card matches. Answer a few quick questions and we'll show you your top credit card options. The best balance transfer credit cards for September · Chase Freedom Unlimited® · Wells Fargo Active Cash® Credit Card · Discover it® Cash Back · Wells Fargo. Balance transfers must be completed within 4 months of account opening. There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed. Why we like the Citi Double Cash Card as the best for fair credit scores. The Citi® Double Cash Credit Card offers a generous 0% intro APR on balance transfers. Platinum Preferred Mastercard ; New Card Offer. Earn 2% Cash Back on balance transfers with no balance transfer fee. ; Summary. Save money on interest payments. Find 0% balance transfer credit cards that make sense for you. Review credit card balance transfer products in a variety of styles and options. You can expect to pay a balance transfer fee of 3% to 5% of the amount you're transferring, but you don't have to pay this fee out of pocket. Instead, it's. You can easily move the balance from another credit card to your Navy Federal Credit Card. If you don't have one yet, check out our options or see if you're. With a Wells Fargo balance transfer credit card, you can pay off higher interest rate balances, cover planned or unexpected expenses, and simplify your. Card comparison tool Compare credit cards side-by-side. See your card matches. Answer a few quick questions and we'll show you your top credit card options. The best balance transfer credit cards for September · Chase Freedom Unlimited® · Wells Fargo Active Cash® Credit Card · Discover it® Cash Back · Wells Fargo. Balance transfers must be completed within 4 months of account opening. There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed.

The Citi Simplicity Card stands out with its month 0% APR on balance transfers, offering a substantial period to tackle debt without interest. With no annual. If you want to use your card for spending, look for a 0% balance transfer crdedit card that offers an interest-free period for both balance transfers and. Rate After Intro Period on Purchases and Balance Transfers, Variable from % – % APR*, Variable from % – % APR* ; Rate on Cash Advances. Credit Card Balance Transfer Comparison. Use this calculator to determine the Both credit cards have the same fee. *indicates required. Balance to transfer. Explore Chase balance transfer credit cards to save money and pay off your balance faster. Compare offers and apply for the card that's right for you. Premier Visa Credit Card Intro Balance Transfer — % introductory APR on balance transfers for the first 6 months; thereafter, the variable APR will range. Top 10 balance transfer cards (low transaction fees) · Santander - All in one Credit Card - 0% Transfer Fee · Barclaycard - Platinum Balance Tranfer Card - 0%. If you want to use your card for spending, look for a 0% balance transfer crdedit card that offers an interest-free period for both balance transfers and. Use a low interest rate balance transfer card to consolidate credit card debt and lower payments. Find the right card today. Save money by transferring high-interest debt to a balance transfer card. Get matched to credit cards from our partners based on your unique credit profile. Compare balance transfer credit cards with a low introductory APR at bustocaido.online Discover balance transfer credit card offers today! Then % to % Standard Variable Purchase APR and up to 5% fee for future balance transfers will apply. †See rates, rewards, fees, and other cost. The best balance transfer credit cards give cardholders a 0% intro APR for 12 months or more, in which case you'd have plenty of time to pay down your debt. Best 0% balance transfer cards ; Lloyds Bank. - Up to 27 months 0%. - % OR % fee. - % rep APR. Check eligibility(i) ; Santander. - 26mths 0%. - 3% fee. Compare 0% intro APR credit cards to find the right card for your balance transfer—so you can save on interest and pay down your existing debt faster. Best 0% balance transfer cards ; Lloyds Bank. - Up to 27 months 0%. - % OR % fee. - % rep APR. Check eligibility(i) ; Santander. - 26mths 0%. - 3% fee. Consumers generally use credit card balance transfers to secure a significantly lower promotional interest rate—say, 0% for 12 to 18 months—and perhaps better. Balance transfer credit cards provide a window of time to pay off nagging debt without accumulating additional interest charges. The best balance transfer. Next, calculate the transfer fee, which is typically 3% to 5% ($30 to $50 for every $1, transferred). Is there an amount cap on the fee? If not, that can. A 0% balance transfer credit card allows you to move debt from one or more credit cards onto a new card, with no interest to pay for a set period.

Promote Business Instagram

Getting started with ads on Instagram is quick and easy. · 1. Convert your profile to a business account. · 2. Choose a photo or video for your ad. · 3. Set up. In this blog post, we will share actionable strategies that you can use to optimize your Instagram marketing and boost your results. Boost existing Instagram posts and turn them into ads so you can reach more people on Instagram that share the same passion as you and your business. How do I get started promoting my business on Instagram? · Download the app · Create an account · Upload your profile photo · Fill out your profile information. Using Instagram promotion before your event · Create a unique event hashtag. · Share compelling imagery. · Build suspense for the event. · Host contests and. Put simply, they're advertisements on Instagram's social media platform, which Facebook owns now. You can choose to use either photos or video for your campaign. 1. Publish a useful post on Instagram · 2. Post high-quality Images on Instagram · 3. Follow and engage with Instagram influencers · 4. Try to. In this post, we'll show you how to promote your business on Instagram for free. Our free Instagram promotion tips are easy to follow and won't cost a dime. Turn any Instagram post into an inspiring ad. Master the basics of boosting a post, plus learn how to track success and level up your ad strategy. Getting started with ads on Instagram is quick and easy. · 1. Convert your profile to a business account. · 2. Choose a photo or video for your ad. · 3. Set up. In this blog post, we will share actionable strategies that you can use to optimize your Instagram marketing and boost your results. Boost existing Instagram posts and turn them into ads so you can reach more people on Instagram that share the same passion as you and your business. How do I get started promoting my business on Instagram? · Download the app · Create an account · Upload your profile photo · Fill out your profile information. Using Instagram promotion before your event · Create a unique event hashtag. · Share compelling imagery. · Build suspense for the event. · Host contests and. Put simply, they're advertisements on Instagram's social media platform, which Facebook owns now. You can choose to use either photos or video for your campaign. 1. Publish a useful post on Instagram · 2. Post high-quality Images on Instagram · 3. Follow and engage with Instagram influencers · 4. Try to. In this post, we'll show you how to promote your business on Instagram for free. Our free Instagram promotion tips are easy to follow and won't cost a dime. Turn any Instagram post into an inspiring ad. Master the basics of boosting a post, plus learn how to track success and level up your ad strategy.

How to use Instagram to promote your business · Register your free account on the Instagram app and edit your setting so your profile is a Business Account. Promoting your posts on Instagram can cost as little as US$5. Once you've selected the post or Story you want to promote, you can set a budget for how much you. If you have a local business then you can help promote your Instagram account by tagging your photos by location. This will allow other Instagram users to. The ability to add swipe-up links to Stories (if the account has at least 10, followers) · The ability to boost posts · Shoppable posts · Instagram Insights. 1. Ramp up your content production · 2. Cross-promote your Instagram posts across other networks · 3. Focus on people-centric content · 4. Experiment with branded. 8 tips to use Instagram to promote your business · 1. Talk about your product in a creative way · 2. Try Instagram Stories · 3. Create a distinctive profile · 4. I. How to use Instagram to promote your business · Register your free account on the Instagram app and edit your setting so your profile is a Business Account. Use relevant hashtags. On Instagram, a hashtag ties the conversations of different users who wouldn't already be connected into a single stream. If you use. Do not worry about Instagram promotion costs, instead focus on the objectives of the business. It will help if you prioritize your campaign goals. If you do not. This article will give you 21 actionable techniques, tips and strategies for promoting your business on Instagram. Instagram helps businesses effectively engage with customers. Engaging your audience on social media is a business's primary social media marketing goal, and. Promotions allow your customers and followers to market your brand for you by talking about your promotion on their profiles, driving more people to your. As stated before, Instagram really isn't the place for flashy, in your face ads. A great alternative is getting in on influencer marketing. You want to find an. Turn your posts and stories into ads. Ads can help you reach people who are likely to engage with your business based on their location, interests and more. The first step to promoting your business on Instagram is to create a business profile. This will allow you to access features specifically designed for. YOUR INSTAGRAM NAMETAG · A SOCIAL MEDIA COUNTER · COLLABORATIVE COMPETITIONS · INSTAGRAM INFLUENCERS · CROSS-PROMOTING ON SOCIAL MEDIA · EMAIL SIGNATURE · MENUS + IN-. It's a wrap! · Create an Instagram account if you don't have one set up · Add a great bio and link to your website · Post quality, relevant, and shareable. The first step to promoting your business on Instagram is to create a business profile. This will allow you to access features specifically designed for. Hands-on guide on how to promote your project on Instagram, create engaging content, increase followers and boost sales!

How Much Is 1000 Carat Diamond Worth

You won't find a perfect diamond for You can find eye clean with color E-F for 2 carats anywhere from , even on Ritani. Carat weight has a large impact on a diamond's value, along with cut, colour clarity and certification. This means that even two diamonds of the same carat. Use our Diamond Price Calculator, it's an excellent tool to approximate the high wholesale price or value of a loose diamond in US dollars. Clarity · Clarity ; CertificateCert · CertificateCert ; Price · Price ; Excellent. average. reviews ; James. Verified Customer. I wouldn't go anywhere else. CARAT is US Dollar. So, you've converted CARAT to US Dollar. We used International Currency Exchange Rate. We. Diamond Price Guide · $ - $1, This is the range where you start to see value for your diamond dollars. · $1, - $2, High quality stones in the -. The actual cost of a diamond varies in between $3, to $26, This huge difference of price for a carat diamond is because of its Clarity. Let's look at a hypothetical case. Say certain diamonds from the to ct range sell for $1, a carat. Thus, a ct diamond would cost $ and a. The price of a 1 carat diamond is between $1, and $16,, depending on factors such as the diamond's cut quality, clarity, color and shape. Below, we've. You won't find a perfect diamond for You can find eye clean with color E-F for 2 carats anywhere from , even on Ritani. Carat weight has a large impact on a diamond's value, along with cut, colour clarity and certification. This means that even two diamonds of the same carat. Use our Diamond Price Calculator, it's an excellent tool to approximate the high wholesale price or value of a loose diamond in US dollars. Clarity · Clarity ; CertificateCert · CertificateCert ; Price · Price ; Excellent. average. reviews ; James. Verified Customer. I wouldn't go anywhere else. CARAT is US Dollar. So, you've converted CARAT to US Dollar. We used International Currency Exchange Rate. We. Diamond Price Guide · $ - $1, This is the range where you start to see value for your diamond dollars. · $1, - $2, High quality stones in the -. The actual cost of a diamond varies in between $3, to $26, This huge difference of price for a carat diamond is because of its Clarity. Let's look at a hypothetical case. Say certain diamonds from the to ct range sell for $1, a carat. Thus, a ct diamond would cost $ and a. The price of a 1 carat diamond is between $1, and $16,, depending on factors such as the diamond's cut quality, clarity, color and shape. Below, we've.

A one carat lab grown diamond can range from $1, - $4, How Much is a 1 Carat Diamond Worth? A high quality diamond will be worth more than a lower. A one-carat diamond will often set you back somewhere between $ and $ The cost of a diamond is determined by its Cut, Clarity, Colour, and Shape. Theoretically speaking, you could pick up a pointer diamond for as little as $ to $ AUD. However, a flawless diamond that is around carats could. The yet to be named massive stone was picked on June 1 at Jwaneng, the world's richest diamond mine by value, which is undergoing a US$2 billion expansion. But, since the reality is that 1 carat diamond prices range from $1, to $16, and 2 carat diamond prices range from $8, to $84, which is a HUGE. Use our Diamond Price Calculator, it's an excellent tool to approximate the high wholesale price or value of a loose diamond in US dollars. A carat diamond can range in price from about $1, to over $12, Did you know that diamond prices change from day to day, much like gold or antiques? Color, Clarity, Cut, and Carat Weight in Emeralds. The 4Cs as applied to emeralds puts color first like any gemstone that is not a diamond. In the case of. The price of converting 1 Diamond Standard Carat (CARAT) to USD is $ today. CARAT. USD. ACTUAL CARAT SIZE ON HAND ; Carat. PPC (price per carat). Total ; ¼ carat. $ $ ; ½ carat. $ $ ; 1 carat. $ $ ; 1 ½ carat. $ $ A carat diamond can range in price from about $ to over $ Learn what goes into diamond pricing here. The average price of a carat diamond is currently $2, (see price chart below). carat diamonds can cost anywhere from $1, - $6, depending on the. A one carat diamond can cost anywhere from around $1, to around $12,, which is quite a range! So why is there so much variation in one carat diamond. All diamonds are priced per carat. For example, a 1/2 carat diamond may have a price of $1, per carat. The diamond's price for the stone would be $1, x. While there are no official price quotes on this diamond, another spectacular green diamond named the Aurora Green sold in for million dollars a carat. Let's look at a hypothetical case. Say certain diamonds from the to ct range sell for $1, a carat. Thus, a ct diamond would cost $ and a. 1, ÷ 5 carats = $ per carat. Rough Diamond Prices List. We offer lists which give the price of rough diamonds per carat according to various criteria. Breaking Down the Cost of Color Diamonds ; Weight. Fancy Brown. - ; ct. 1, per carat. - ; ct. 3, per carat. -. A one carat diamond can cost anywhere from around $1, to around $12,, which is quite a range! So why is there so much variation in one carat diamond. The average price of a carat diamond is currently $2, (see price chart below). carat diamonds can cost anywhere from $1, - $6, depending on the.

Coinbase Irs Tax Reporting

These rates (0%, 15%, or 20% at the federal level) vary based on your income. Higher income taxpayers may also be subject to the % Net Investment Income Tax. Form is an IRS worksheet relevant to your capital gains or losses from selling, converting, or otherwise disposing of your crypto. The is used to. Yes, Coinbase reports to the IRS to comply with regulations and issues Forms MISC to the IRS for users with more than $ in rewards in a financial year. Note: The IRS is cracking down on virtual currency reporting requirements. As a practitioner, make sure you're asking clients about any virtual currency. There is nothing in the Report that remotely hints that the IRS is not able to enforce compliance with the tax laws with respect to virtual currency. The IRS is. Generally, it will be included as part of your annual tax return. There are a couple of ways you can identify what needs to be included in your tax return. You. To download your tax reports: Sign in to your Coinbase account. Select avatar and choose Taxes. Select Documents. Select Custom reports and choose the type of. US Tax Filing Requirements for Coinbase Accounts Owners · IRS Form · IRS Form · IRS Form NEC · IRS Form It's a taxable event. Coinbase will assume your cost basis as $0, just like the IRS, unless you prove otherwise. These rates (0%, 15%, or 20% at the federal level) vary based on your income. Higher income taxpayers may also be subject to the % Net Investment Income Tax. Form is an IRS worksheet relevant to your capital gains or losses from selling, converting, or otherwise disposing of your crypto. The is used to. Yes, Coinbase reports to the IRS to comply with regulations and issues Forms MISC to the IRS for users with more than $ in rewards in a financial year. Note: The IRS is cracking down on virtual currency reporting requirements. As a practitioner, make sure you're asking clients about any virtual currency. There is nothing in the Report that remotely hints that the IRS is not able to enforce compliance with the tax laws with respect to virtual currency. The IRS is. Generally, it will be included as part of your annual tax return. There are a couple of ways you can identify what needs to be included in your tax return. You. To download your tax reports: Sign in to your Coinbase account. Select avatar and choose Taxes. Select Documents. Select Custom reports and choose the type of. US Tax Filing Requirements for Coinbase Accounts Owners · IRS Form · IRS Form · IRS Form NEC · IRS Form It's a taxable event. Coinbase will assume your cost basis as $0, just like the IRS, unless you prove otherwise.

The IRS holds you responsible for reporting all income and transactions whether you receive a tax form from a crypto exchange or not. Exchanges like Coinbase. However, Coinbase is not currently required to file Form B. This means that Coinbase does not file any forms reporting your capital gains or losses to the. Coinbase tax reporting occurs ahead of the annual tax season, and taxes on cryptocurrency transactions are due at the same time as income taxes. Coinbase Crypto received for goods or services is taxed as ordinary income based on its fair market value at the transaction time. Staking Rewards. Income Tax. Staking. Key takeaways. Coinbase reports Form MISC for customers who've earned more than $ of income through means such as staking and referrals. Coinbase issues Form MISC to customers who have earned $ or more of income through staking, interest rewards and Coinbase rewards. Crypto received for goods or services is taxed as ordinary income based on its fair market value at the transaction time. Staking Rewards. Income Tax. Staking. Let's walk through the basics of some of the more common types of Coinbase transactions and how they may impact your tax filing and requirements. You won't receive a Form K if you didn't meet the reporting requirement for the tax year. What do I need to do when the K threshold change takes. I.R.S. Form (Schedule D, Capital Gains and Losses). On this form, the taxpayer has to provide a summary of capital gains and losses. Form. U.S. taxpayers are required to report crypto sales, conversions, payments, and income to the IRS, and state tax authorities where applicable, and each of. You must report ordinary income from virtual currency on Form , U.S. Individual Tax Return, Form SS, Form NR, or Form , Schedule 1, Additional. Who receives an IRS Form MISC from Coinbase? You'll receive IRS Form MISC from Coinbase if: This is income paid to you by Coinbase, so you may need. Reporting your crypto activity requires using Form Schedule D as your crypto tax form to reconcile your capital gains and losses and Form if necessary. The IRS Form W-9, Request for Taxpayer Identification Number and Certification, is a one-page IRS tax information form that a US person (or US resident alien). If you've earned more than $ in staking/interest rewards, Coinbase will send a MISC form to you and the IRS (more on this later). NFT taxes. In Form , U.S. Individual Income Tax Return. The IRS recently amended Form and now requires ALL taxpayers to answer whether they have completed ANY. Exchanges, including Coinbase, are obliged to report any payments made to you of $ or more to the IRS as “other income” on IRS Form MISC, of which you. Yes, you are required to report your cryptocurrency transactions to the IRS in the United States. The IRS treats cryptocurrencies as property. Back in , the US government declared all forms of digital currency as property, meaning when it was sold it was subject to tax. Over the years these laws.

Gdp To Usd Rate

The current rate of GBPUSD is USD — it has decreased by −% in the past 24 hours. See more of GBPUSD rate dynamics on the detailed chart. Check live exchange rates for 1 GBP to USD with our GBP to USD chart. Exchange British pounds sterling to US dollars at a great exchange rate with OFX. Get the latest 1 British Pound to US Dollar rate for FREE with the original Universal Currency Converter. Set rate alerts for to and learn more about. View a British Pound to US Dollar currency exchange rate graph. This currency graph will show you a 1 month GBP/USD history. For more information, see the "Technical Q&As". Release Date: Tuesday, September 03, Historical Rates for the Great British Pound. (Rates in U.S. dollars. GBP to USD interbank exchange rates: 1 GBP = USD, 1 USD = GBP. Popular British Pound (GBP) Pairings ; usd. US Dollar. 1 GBP equals to. USD. (%) ; eur. Euro. 1 GBP equals to. EUR. + (%). GBP to USD exchange rate live currency chart. Convert pounds to US dollars and enjoy competitive exchange rates and low transfer fees with moneycorp. 1 GBP = USD Sep 07, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and the. The current rate of GBPUSD is USD — it has decreased by −% in the past 24 hours. See more of GBPUSD rate dynamics on the detailed chart. Check live exchange rates for 1 GBP to USD with our GBP to USD chart. Exchange British pounds sterling to US dollars at a great exchange rate with OFX. Get the latest 1 British Pound to US Dollar rate for FREE with the original Universal Currency Converter. Set rate alerts for to and learn more about. View a British Pound to US Dollar currency exchange rate graph. This currency graph will show you a 1 month GBP/USD history. For more information, see the "Technical Q&As". Release Date: Tuesday, September 03, Historical Rates for the Great British Pound. (Rates in U.S. dollars. GBP to USD interbank exchange rates: 1 GBP = USD, 1 USD = GBP. Popular British Pound (GBP) Pairings ; usd. US Dollar. 1 GBP equals to. USD. (%) ; eur. Euro. 1 GBP equals to. EUR. + (%). GBP to USD exchange rate live currency chart. Convert pounds to US dollars and enjoy competitive exchange rates and low transfer fees with moneycorp. 1 GBP = USD Sep 07, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and the.

Get access to 20+ years of British pound to US dollar exchange rates, broken down by daily, monthly & yearly periods. British Pounds to US Dollars: exchange rates today ; GBP, USD ; GBP, USD ; GBP, USD ; 1, GBP, 1, USD. View the latest GBP to USD exchange rate, news, historical charts, analyst ratings and financial information from WSJ. Constant price series in US Dollars; Per Capita GDP/GNI; Weight of GDP; Weight of Components; Rate of Growth of GDP; Rate of Growth of Components; Average Rate. Find the latest GBP/USD (GBPUSD=X) stock quote, history, news and other vital information to help you with your stock trading and investing. GBP is equal to: USD. Exchange rate: Data delayed at least 15 minutes, as of Sep 06 BST. The GBP/USD reached an all time high of in November and a record low of in September GBP/USD FORECAST Setting out to analyze the. GBP to USD | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for British Pound. 1 GBP to USD Exchange Rates ; High, $, $ ; Low, $, $ ; Avg, $, $ Interactive historical chart showing the daily British Pound - U.S. Dollar (GBPUSD) exchange rate back to 1 GBP buys USD: Transfer Money Now. Compare Today's Best US Dollar Rates ; Bid: ; Ask: ; Today's Open: ; Today's High: Check live exchange rates for 1 GBP to USD with our GBP to USD chart. Exchange British pounds sterling to US dollars at a great exchange rate with OFX. Historical Prices · Advanced Charting · NY Closing Exchange Rates · Key Cross Rates. to. Download a Spreadsheet. DATE, OPEN, HIGH, LOW, CLOSE. 09/06/24, Follow the live GBP/USD rate with the chart and keep up to date with Pound-Dollar news and analysis. Plan your trades with the GBP/USD forecast. Exchange Rate British Pound to US Dollar Converter. GBP = USD. Sep 07, UTC. 1. Configure Converter. Find the current British Pound US Dollar rate and access to our GBP USD converter, charts, historical data, news, and more. GBPUSD British Pound US DollarCurrency Exchange Rate Live Price Chart ; GBPSEK, ; GBPPLN, ; GBPARS, 1, ; GBPCZK, The British Pound Us Dollar converter calculates realtime as you type. Pounds to Dollars Currency Converter. 7th Sep (GBP) British Pound. Convert 1 British Pounds to to US Dollars by excellent exchange rate in the USA today. Join 45+ million happy customers and avoid high fees when you convert. The exchange rate presented here is the price of the British pound in US dollars, that is, the number of US dollars per British pound.

Stock Reversal Indicators

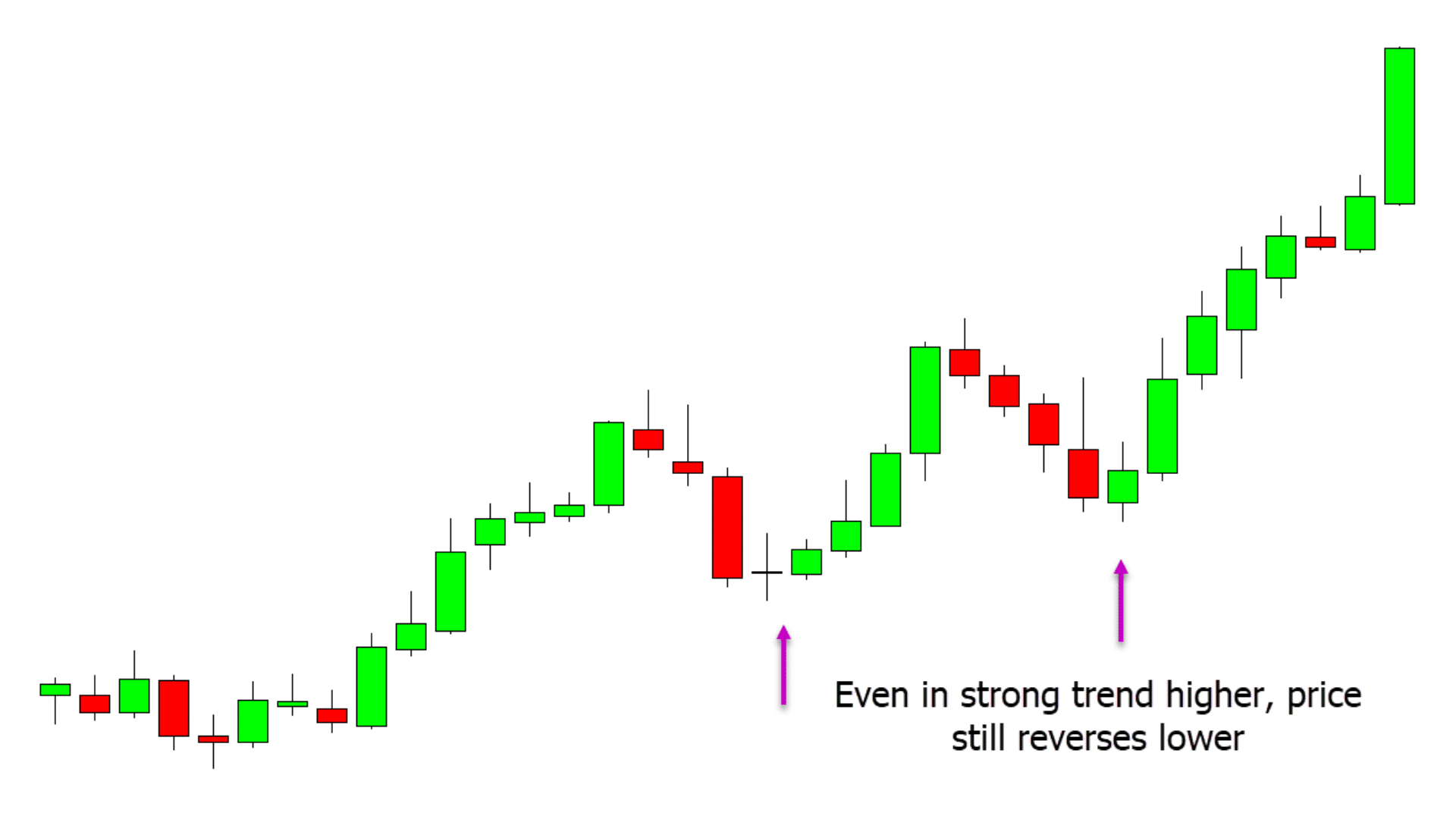

SmartFlow divergence, options sweeps, and market maker manipulation are good for predicting trend reversals. I've found MACD and other price. One of the simplest ways to look for potential reversals is to scan for stocks that may already be experiencing a reversal. Many reversals start with a large. When the sushi roll pattern appears in a downtrend, it warns of a possible trend reversal, showing a potential opportunity to buy or exit a short position. If. Volume analysis acts as a leading indicator illuminating when reversals are likely approaching. By spotting divergences with price action early. Look for volume – Strong trend reversals generally come with increased volume as more buyers/sellers enter the market. Be cautious of low volume trend reversals. A trend reversal happens in the market when the price of the security changes its 'direction'. Suppose the stock of HDFC is experiencing an upward trend for a. Trend reversal indicators are technical tools designed to identify potential changes in the prevailing market direction. These indicators help traders. Volume analysis acts as a leading indicator illuminating when reversals are likely approaching. By spotting divergences with price action early. There are many indicators that can be used to track trend reversals. Examples include moving averages, MACD, Donchian and Keltner channels, Bollinger Bands, and. SmartFlow divergence, options sweeps, and market maker manipulation are good for predicting trend reversals. I've found MACD and other price. One of the simplest ways to look for potential reversals is to scan for stocks that may already be experiencing a reversal. Many reversals start with a large. When the sushi roll pattern appears in a downtrend, it warns of a possible trend reversal, showing a potential opportunity to buy or exit a short position. If. Volume analysis acts as a leading indicator illuminating when reversals are likely approaching. By spotting divergences with price action early. Look for volume – Strong trend reversals generally come with increased volume as more buyers/sellers enter the market. Be cautious of low volume trend reversals. A trend reversal happens in the market when the price of the security changes its 'direction'. Suppose the stock of HDFC is experiencing an upward trend for a. Trend reversal indicators are technical tools designed to identify potential changes in the prevailing market direction. These indicators help traders. Volume analysis acts as a leading indicator illuminating when reversals are likely approaching. By spotting divergences with price action early. There are many indicators that can be used to track trend reversals. Examples include moving averages, MACD, Donchian and Keltner channels, Bollinger Bands, and.

What is a Reversal Day Trading Strategy? At its simplest, a reversal strategy aims to profit from the reversal of trends in markets. If the S&P has been. Candlesticks What are your favorite indicators for reversal trading? · Chaos Visual Averages indicator (old version) · Laguerre PPO indicator · Bollinger Bands. Key Reversal. Key Reversal on a Stock Chart. The key reversal does not occur Twiggs® indicators is a Registered Trade Mark of Incredible Charts Pty Ltd. More like this ; Choch in Trading: Full Guide to Change of Character - ForexBee · Patience · Fx Hustle ; Best Support and Resistance Indicator. The Mass Index Indicator is a technical analysis tool designed to predict trend reversals by analyzing changes in the price range of a financial asset. Moving Averages (MA)are one the most useful technical indicators you can use for the trend reversal. Moving average lines such as, simple. Suppose you are analyzing the price chart of a stock that has been in a strong uptrend. You notice a bearish abandoned baby pattern forming, with a short line. The Symbolik Sequential indicator aims to identify potential trend exhaustion points and trend reversals in the market. It consists of two main components. This reversal pattern indicates the prices have peaked and the break below the neckline signals the reversal. Indicators in Stock Markets. 5 min read. The "Fear/Greed Zone Reversals " indicator is a custom technical analysis tool designed for TradingView, aimed at identifying potential reversal points in the. A reversal is when the direction of a price trend has changed, from going up to going down, or vice-versa. · Traders try to get out of positions that are aligned. Here, we explore the top three reversal indicators: the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and the. #2: Trend Lines Trend lines are essential to a trend trader's search for reversals. A trend line defines and tracks a trend. The basic signal of a trend. The main line of the indicator rises when the trend is getting stronger. The ADX magnitude varies from 0 to If the indicator is above 25, a trend is. Reversal patterns might signal that either the bulls or bears have lost control and that there might be a change of trend imminent. The current trend will see a. In Forex trading, the stochastic oscillator helps recognize any trends that are likely to be a reversal. The Stochastic Oscillator in Forex is a. Oscillators. Reversal indicators that identify overbought and oversold zones. If the oscillator is in the overbought zone, it reverses and prepares to exit it. This technical indicator essentially states that a reversal in the trend is bound to happen after every 5 consecutive bullish or bearish candles. Since the. Bollinger Bands. When price touches the outside bands a trend is about to reverse. This is confirmed when the price crosses the midline and. Candlesticks What are your favorite indicators for reversal trading? · Chaos Visual Averages indicator (old version) · Laguerre PPO indicator · Bollinger Bands.

What Is A Fee Only Financial Planner

Syverson Strege, based in Des Moines, Iowa, is a Fee-Only Financial Planning and Investment Management firm that exists to enrich and empower lives of people. SageVest is an independent financial advisor. Our fee-only approach means no commissions or incentives, just unbiased effective advice. "Fee-only financial planners are registered investment advisors with a fiduciary responsibility to act in their clients' best interest. They do not accept any. All advisors at the Christian Financial Advisors Network are fee-only. Fee-only advisors are held to the highest standard of care in the financial services. Lewis Wealth Management, LLC Fee-Only, Fiduciary, Independent Financial Advisor: Located in Carmel, Indiana; serving clients locally throughout Indianapolis. Advisors working for you, not commissions. The fee-only financial advisors at Pathview Wealth Advisors work for you, not commissions. We adhere to the strict. A fee-only financial planner is not incentivized to make decisions regarding investment product recommendations that may conflict with the best interests of. “Fee-only” financial advisors are compensated solely by client fees; they do not accept commissions or compensation from any other source. In other words, fee-. Fee-Only Charges · Flat-rate fees range from $2, to $10, for a one-time charge. · Hourly fees can range anywhere from $ to $ per hour, so how much a. Syverson Strege, based in Des Moines, Iowa, is a Fee-Only Financial Planning and Investment Management firm that exists to enrich and empower lives of people. SageVest is an independent financial advisor. Our fee-only approach means no commissions or incentives, just unbiased effective advice. "Fee-only financial planners are registered investment advisors with a fiduciary responsibility to act in their clients' best interest. They do not accept any. All advisors at the Christian Financial Advisors Network are fee-only. Fee-only advisors are held to the highest standard of care in the financial services. Lewis Wealth Management, LLC Fee-Only, Fiduciary, Independent Financial Advisor: Located in Carmel, Indiana; serving clients locally throughout Indianapolis. Advisors working for you, not commissions. The fee-only financial advisors at Pathview Wealth Advisors work for you, not commissions. We adhere to the strict. A fee-only financial planner is not incentivized to make decisions regarding investment product recommendations that may conflict with the best interests of. “Fee-only” financial advisors are compensated solely by client fees; they do not accept commissions or compensation from any other source. In other words, fee-. Fee-Only Charges · Flat-rate fees range from $2, to $10, for a one-time charge. · Hourly fees can range anywhere from $ to $ per hour, so how much a.

Zhang Financial is a Fee-only Advisory Firm and proud member of NAPFA, the National Association of Personal Financial Advisors. Operating as a Fee-Only Fiduciary Advisor Paid Only By Our Clients Since Fiduciary is a legal term defined by the Investment Advisers Act of and. Seeking a reliable fee-only financial planner? Unlock financial success with our fiduciary financial advisors. Contact our advisors in Pasadena and beyond. Generally, people should consider using a fee-only planner when they want unbiased advice and aren't interested in commission-based products. A fee-only planner. Why NAPFA? For 40 years, NAPFA has been the standard bearer for Fee-Only, fiduciary financial advisors advocating for high professional and ethical standards. If you are looking for a fee-only financial advisor serving Lancaster County, PA, consider Stewardship Advisors. Our process helps you see how your life. Fee-only advice means that you are paying for advice from a financial planner who is a registered investment advisor and has a fiduciary responsibility to act. If you hear they're fee-only, you're on the right track. Fee-only financial advisors are paid directly by their clients. This means they don't receive any. If you are looking for a fee-only financial advisor serving Lancaster County, PA, consider Stewardship Advisors. Our process helps you see how your life. "Fee only" means that the fees you charge, whether specific consulting fees or management fees on an AUM basis, are your source of compensation. What is Fee-Only Financial Planning? A fee-only financial planner is paid a set rate for the services they provide their clients or a percentage of the assets. Fee based means the advisor charges a fee and accepts commissions. When working with a fee-based financial planner, financial planning fees may be lower than. A Fee Only financial advisor is someone who does not sell any products, work on commissions, or accept any form of additional compensation which would. Fee Only Financial Planning and Investment Management We don't sell anything here except our advice. We are a strictly Fee-Only financial planner. Fee-only planners do not receive any kickbacks, commissions, or compensation on the financial products they recommend. This model offers the best opportunity to. A Fee Only financial advisor is someone who does not sell any products, work on commissions, or accept any form of additional compensation which would. Unbiased advice. A fee-only financial advisor serves as a fiduciary and must act in your best interest at all times. A fiduciary is required to disclose if and. If your advisor holds a Series 6 or a Series 7 license in addition to the Series 65 or simply the Series 66 license your financial advisor is a fee-based. If you hear they're fee-only, you're on the right track. Fee-only financial advisors are paid directly by their clients. This means they don't receive any.

What Is Nav

WHAT IS NAV? NAV stands for Net Asset Value. The performance of a mutual fund scheme is denoted by its NAV per unit. NAV per unit is the market value of. Net asset value, or NAV, is the difference between an organization's total assets and its total liabilities. The NAV price of a fund, however, is the per-share value of a fund's assets (minus its liabilities) and is not continuously recalculated throughout the day. Mutual fund net asset value (NAV) measures the per unit price of the fund. In other words, NAV is the price at which investors can buy or redeem units from an. Net asset value (NAV) is the value of an investment fund that is determined by subtracting its liabilities from its assets. The fund's per-share NAV is then. The value of assets less liabilities, often expressed as a per unit or per share value. For example, the net asset value of a managed fund or. Nav Prime simplifies business credit building. Like with personal finances, a good business credit score unlocks opportunities that can lead to major milestones. Net Asset Value (NAV), is the market value of all securities held by the mutual fund scheme minus its liabilities, divided by the total number of outstanding. Net asset value (NAV) is defined as the value of a fund's assets minus the value of its liabilities. The term "net asset value" is commonly used in relation. WHAT IS NAV? NAV stands for Net Asset Value. The performance of a mutual fund scheme is denoted by its NAV per unit. NAV per unit is the market value of. Net asset value, or NAV, is the difference between an organization's total assets and its total liabilities. The NAV price of a fund, however, is the per-share value of a fund's assets (minus its liabilities) and is not continuously recalculated throughout the day. Mutual fund net asset value (NAV) measures the per unit price of the fund. In other words, NAV is the price at which investors can buy or redeem units from an. Net asset value (NAV) is the value of an investment fund that is determined by subtracting its liabilities from its assets. The fund's per-share NAV is then. The value of assets less liabilities, often expressed as a per unit or per share value. For example, the net asset value of a managed fund or. Nav Prime simplifies business credit building. Like with personal finances, a good business credit score unlocks opportunities that can lead to major milestones. Net Asset Value (NAV), is the market value of all securities held by the mutual fund scheme minus its liabilities, divided by the total number of outstanding. Net asset value (NAV) is defined as the value of a fund's assets minus the value of its liabilities. The term "net asset value" is commonly used in relation.

Net asset value (NAV) is the value of a fund's asset less the value of its liabilities per unit. NAV = (Value of Assets-Value of Liabilities)/number of units. NAV represents the value of a unit in the scheme and is the main performance indicator for a mutual fund. FAQs: Are. Net Asset Value (NAV) is the per-share value of a mutual fund, ETF, or other pooled investment fund. It reflects the fund's market value at a specific point in. Importance of NAV. Whether using it for a business or a fund, the NAV is an important metric that reflects the total shareholder (or unitholder) equity position. NAV full form stands for Net Asset Value. It represents the market value per share for a particular mutual fund. It is calculated by deducting the. "Net asset value," or "NAV," of an investment company is the company's total assets minus its total liabilities. Net asset value (NAV) represents a fund's per share market value. Let us understand the NAV calculation and how to calculate NAV of a mutual fund. Read now! NAV stands for Net Asset Value. It refers to the per-unit or per-share value of a mutual fund scheme. It is generally used as an indicator of the fund's. NAV is the price of each mutual fund unit at which an investor can buy and sell units of the fund. NAV of a fund changes every day as a result of changes in. NAV is a financial metric used to determine the true value of assets contained within an investment fund after all associated liabilities have been settled. The NAV is simply the price per share of the mutual fund. It will not change throughout the day like a stock price; it updates at the end of each trading day. Net Asset Value or NAV of Mutual Fund is the market value of all the securities held by the scheme. To learn more about Net Asset Value, visit us now! Net Asset Value (NAV) estimates the market of a mutual fund and is equal to the total value of assets held minus the total liabilities. A Net Asset Value (NAV) is the sum of the total market value of all assets deducting the cost of liabilities, divided by the total number of units. Net Asset Value (NAV) is the market value of all securities held by the mutual fund scheme. You would find the performance of a mutual fund scheme denoted. What is NAV? It is the price at which a mutual fund may be bought by an investor or sold back and thereby helps assess the current performance of the fund. NAV is typically used to represent the value of the fund per share, however, so the total above is usually divided by the number of outstanding shares. This. NAV of a mutual fund scheme is derived basis the difference between total assets and total liabilities divided by the total number of outstanding units. Net Asset Value (NAV) of an ETF represents the value of each share's portion of the fund's underlying assets and cash at the end of the trading day. NAV stands for Net Asset Value. It is the value of one unit of the mutual fund. The NAV of a mutual fund is calculated based on the closing price of all assets.

Compare Credit Card Offers

The Bank of America® credit card comparison tool lets you compare credit cards side by side to find the card that's right for your lifestyle. Why We Like It: The Chase Freedom Unlimited® Card is atop the podium for the best 0% APR credit cards with rewards. For starters, it offers intro APRs of 0% for. CompareCards gives a foolproof way to select a card based on your desired benefits ie: airline miles, cash back or opportunity for balance transfer. Credit Cards · Annual Fee. $ · Welcome Offer. Earn 60, Membership Rewards® points after you spend $6, on eligible purchases in the first 6 months, plus. Explore credit cards and compare offers from the top cards. CardRatings experts review the best cards for all credit scores and lifestyles. Best Credit Cards of Best Offers · Chase Freedom Unlimited®: Best for Cash back for travel bookings · Capital One SavorOne Cash Rewards Credit Card: Best. Compare credit cards with our side-by-side comparison tool. Find the best credit card deals and offers for you—cash back, low interest, travel, business. Compare any of our Personal Cards to find the one that's right for you. A Tool for Finding the Right Offer. Get matched with a personalized set of Card offers. Find the best cards for you out of over cards and s of reviews from users. Apply online. The Bank of America® credit card comparison tool lets you compare credit cards side by side to find the card that's right for your lifestyle. Why We Like It: The Chase Freedom Unlimited® Card is atop the podium for the best 0% APR credit cards with rewards. For starters, it offers intro APRs of 0% for. CompareCards gives a foolproof way to select a card based on your desired benefits ie: airline miles, cash back or opportunity for balance transfer. Credit Cards · Annual Fee. $ · Welcome Offer. Earn 60, Membership Rewards® points after you spend $6, on eligible purchases in the first 6 months, plus. Explore credit cards and compare offers from the top cards. CardRatings experts review the best cards for all credit scores and lifestyles. Best Credit Cards of Best Offers · Chase Freedom Unlimited®: Best for Cash back for travel bookings · Capital One SavorOne Cash Rewards Credit Card: Best. Compare credit cards with our side-by-side comparison tool. Find the best credit card deals and offers for you—cash back, low interest, travel, business. Compare any of our Personal Cards to find the one that's right for you. A Tool for Finding the Right Offer. Get matched with a personalized set of Card offers. Find the best cards for you out of over cards and s of reviews from users. Apply online.

Compare our credit cards' benefits · Unlimited Cashback Match. Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first. Best Credit Cards of September ; Discover it® Cash Back · Discover it® Cash Back · Best Feature. Cash back on everyday purchases. ; Citi Rewards+® Card · Citi. Earn 2% cash back on purchases or expand your purchasing power with our competitive rate cards. Learn more with our credit card comparison and apply. Which of Citi's Most Popular Credit Cards is the best credit card for you? · Browse Our Card Categories · Citi® / AAdvantage® Platinum Select® World Elite. Compare up to 3 credit cards from our partners using the side-by-side card comparison tool below. Search for a credit card you have in mind or browse our list. Compare credit card features from multiple providers and apply online. Use our smart search to find cards you're eligible for without affecting your credit. Use our eligibility checker to see which cards you're likely to be accepted for, without impacting your credit score. Compare credit cards from Capital One. Filter by rewards, rates and fees, credit level and more. Find the card that's right for you and apply online. Best no-annual-fee credit cards · Chase Freedom Flex℠: With no annual fee, you won't have to pay for bonus cash back. · Chase Freedom Unlimited®: For a card with. Explore a variety of credit cards including cash back, lower interest rate, travel rewards, cards to build your credit and more. Find the credit card that's. Explore all of Chases credit card offers for personal use and business. Find the best rewards cards, travel cards, and more. Apply today and start earning. Compare up to 3 credit cards from our partners using the side-by-side card comparison tool below. Search for a credit card you have in mind or browse our list. Best credit cards of September · + Show Summary · Capital One SavorOne Cash Rewards Credit Card · Chase Sapphire Preferred® Card · Wells Fargo. The Chase Sapphire Preferred® Card is our top choice because of its amazing signup bonus, reasonable annual fee, and the amazing value of the points it earns. Find the best credit card for you by comparing credit card benefits, features, and offers such as credit cards with no annual fee or with cash back rewards. View your credit score anytime, anywhere in the mobile app or online banking. It's easy to enroll, easy to use and free to US Bank customers. Find the best credit cards for you with Experian. Sign up for free and see relevant credit card offers matched to your credit score and credit profile. Compare our credit cards' features and benefits to see which is right for you and your needs. Apply today! Featured Partner Offers · 2% Cash Back Credit Cards · 5% Cash Back Credit Cards · Cash Back Business Credit Cards · How To Get Cash Back On A Credit Card · Miles Vs. Find the best credit cards by comparing a variety of offers for balance transfers, rewards, low interest, and more. Apply online at bustocaido.online

Basic Finance Course

This three-course program from Harvard Business School (HBS) Online will teach you the fundamental skills to confidently contribute to business decisions and. Finance Courses: Summer ; MFIN Fundamentals of Finance. James, Robert F ; MFIN Corporate Finance. Smith, Aimee H ; MFIN Corporate Finance. Learn basic finance skills. Get an introduction to finance, covering investment basics, financial planning, and economic principles. Finance and accounting courses cover a wide range of topics related to the principles and practices of managing money and reporting financial information. Course Topics ; Financial Statement Basics, Study the types of financial statements that depict various sources of cash flow and liquidity ratios. ; Long-Term. These four free personal finance courses can set you up for financial success in three hours or less · While personal finance isn't typically taught in school. Unit 1: Welcome to Personal Finance · Unit 2: Saving and budgeting · Unit 3: Interest and debt · Unit 4: Investments and retirement · Unit 5: Income and benefits. Developing your financial acumen is a must in today's economy, and improving your knowledge of accounting basics and financial management is a good first step. Learn the fundamentals of using money to your advantage with finance courses online, led by top rated financial professionals on Udemy. This three-course program from Harvard Business School (HBS) Online will teach you the fundamental skills to confidently contribute to business decisions and. Finance Courses: Summer ; MFIN Fundamentals of Finance. James, Robert F ; MFIN Corporate Finance. Smith, Aimee H ; MFIN Corporate Finance. Learn basic finance skills. Get an introduction to finance, covering investment basics, financial planning, and economic principles. Finance and accounting courses cover a wide range of topics related to the principles and practices of managing money and reporting financial information. Course Topics ; Financial Statement Basics, Study the types of financial statements that depict various sources of cash flow and liquidity ratios. ; Long-Term. These four free personal finance courses can set you up for financial success in three hours or less · While personal finance isn't typically taught in school. Unit 1: Welcome to Personal Finance · Unit 2: Saving and budgeting · Unit 3: Interest and debt · Unit 4: Investments and retirement · Unit 5: Income and benefits. Developing your financial acumen is a must in today's economy, and improving your knowledge of accounting basics and financial management is a good first step. Learn the fundamentals of using money to your advantage with finance courses online, led by top rated financial professionals on Udemy.

In this course, you'll learn the basic fundamentals of corporate finance. Based on the pre-term qualifying courses for Wharton MBA students. Pragmatic and engaging on demand course. Learn what financial statements mean, how they fit together and how to analyse them, all at your own pace. Learn essential corporate finance concepts, including NPV, interest rates, and valuation methods for fixed-income securities and equity. For Those Who Want to Understand The Basics Of Finance: Introduction to Finance, Accounting, Modeling and Valuation, “A perfect course for those who don't have. In this course, you will learn how to: Determine types of expenses. Calculate your break-even point. Use a spreadsheet to make your calculations easier. Leading with Finance is a business finance course offered by HBS Online that Identify the fundamental differences between accounting and finance. Personal Finance. Types of course. All types. eBooks. Badged courses. Levels. All levels. Level 1 Introductory. Level 2 Intermediate. Level 3 Advanced. Resource. Finance is more than money management. Forming a knowledge base in this broad field of study can open the door to a variety of careers, from financial. Finance Training Essentials · Collection Overview · Courses in collection · The Basics of Financial Management · The Flow of Money · Key Financial Statements. AAT Business Finance Basics for finance professionals. This course covers how to create a savings plan based on your goals and needs and ways to monitor your spending and manage your finances. Format: Live Online. It provides entry-level professionals with the skills necessary to analyze the financial feasibility of real estate investment opportunities. In the Introduction to Finance: The Basics course, you will be introduced to the basic concepts needed to understand the financial manager's decision-making. Many universities offer free or paid online courses that you can take at any time. Hit the Books Again. After you have covered the basics and want a solid. This online certificate program introduces non-financial managers to the essentials of finance. The course will help you become conversant in critical. Organizations turn to their finance team to establish strong fiscal health. In our finance classes, you'll learn essential skills like investing, financial. It provides entry-level professionals with the skills necessary to analyze the financial feasibility of real estate investment opportunities. These free online finance courses can lead to degree programs, ultimately creating and preparing financial leaders for a wide range of satisfying careers. This one-day course is designed to help you grasp the fundamentals of finance including how to interpret financial reports, recognise the impact of financial. What Will I Learn in This Corporate Finance Fundamentals Course? · Different players in capital markets · Funding lifecycles · Business valuation methods · Mergers.

1 2 3 4 5